In the last few years, Shein’s marketing strategy has played a crucial role in establishing the brand as an online fast-fashion giant. As of 2023, the Chinese firm had a valuation of $66 billion and dominated 40% of the U.S. market. With its extremely low prices, Shein sells $2 T-shirts and $7 pants, beating the competition. Since its arrival in the United States in 2015, Shein’s sales have boomed, and the pandemic was a catalyst for its explosive expansion. Its revenues increased sixfold in two years, reaching a projected $23 billion in 2022.

Shein has finally filed to go public in the U.S., marking a major milestone for the brand. The brand has transformed fast fashion, keeping up with micro-trends and responding to customers’ ever-evolving needs. But Shein’s success is not merely due to its affordability and trendy designs—Shein’s marketing strategy has been a game-changer in its growth.

Shein’s Marketing Strategy

Browsing Shein’s site can feel endless, with thousands of new products added every day. Unlike conventional retailers, who order huge bulk quantities months in advance, Shein begins with a small-batch production system. Every new product is first made in batches of 100 to 200 units.

Shein’s marketing strategy capitalizes on real-time consumer behavior. The company tracks user activity with sophisticated technology.

As customers click on an item, hover over it, or add it to their cart, the company gathers data to measure interest. If an item grows popular, Shein ramps up production to meet demand. This approach allows the brand to respond instantly to customer needs without taking big inventory risks.

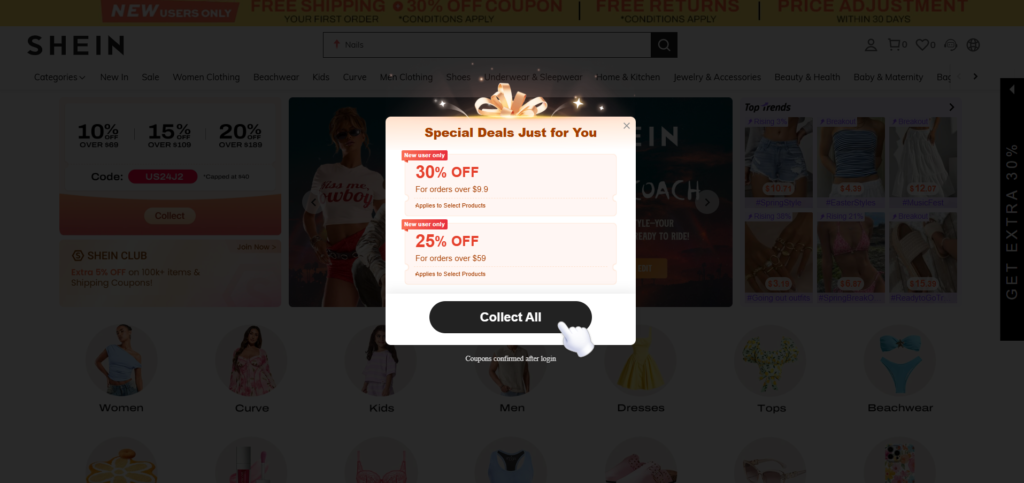

Shein’s inventory turnover is 40 days, which is half that of its rivals, such as H&M and Zara, according to a report by Boston Consulting Group. The small-batch methodology minimizes overproduction and excess inventory, allowing Shein to keep costs low. Shein’s marketing strategy ensures that customers stay engaged, with constant new arrivals and limited-time offers that create urgency.

How Shein Manages Costs and Supply Chains

To sustain its on-demand business model, Shein engages with hundreds of small producers. A Wall Street Journal investigation recorded video footage inside one of its third-party vendor factories in Dongguan, China. The process begins with Shein designers and third-party partners who create products and upload them to the firm’s supplier system. Contract producers then source raw materials from an approved list of suppliers.

If a product gains traction, Shein’s system automatically places repeat orders in real time. This enables the company to monitor fluctuations in demand and adapt operations accordingly. Through small-batch production, Shein claims it cuts excess inventory and reduces production costs by 30-40%.

Yet, while this model saves money for consumers, environmental activists argue that it might not actually reduce waste. Shein’s low prices encourage bulk purchasing behavior, with many consumers often discarding garments after wearing them only a few times. A 2023 report by UBS found that the typical U.S. Shein customer spends approximately $100 a month on women’s clothing—$60 more than the average female consumer. Shein’s marketing strategy fuels this spending pattern by promoting frequent new collections and influencer collaborations that create hype around its products.

Controversies

Shein has also faced multiple accusations regarding its labor practices. The company has been accused of exploiting cheap labor in China and failing to disclose supplier details. In 2022, Shein published the findings of its supplier audits, which indicated instances of “involuntary labor,” but did not specify where or how many cases were found.

The Wall Street Journal discovered that these audits covered only 36% of Shein’s contracted factories. However, the company has stated that it is committed to paying fair wages and improving working conditions. Shein has pledged $70 million toward factory upgrades and worker training.

At the same time, Congress is investigating Shein’s labor practices, particularly its potential use of cotton from China’s Xinjiang province. The U.S. government has accused Chinese officials of employing forced Uyghur labor in Xinjiang, a claim that Beijing denies. While Shein insists it does not source cotton from Xinjiang, analysts argue that the company has not provided sufficient evidence to support this assertion.

Tax Loopholes and Market Competition

Another reason Shein can keep prices so low is its exploitation of a U.S. tax exemption. The de minimis tax rule allows packages valued under $800 to enter the U.S. tariff-free. According to a report by the U.S. House of Representatives, Shein and its competitor Temu account for 30% of all packages shipped under this exemption. Together, the two companies send millions of tariff-free packages into the U.S. each day.

While Shein has expressed support for revising the de minimis rule, the company is also facing increasing competition. Its valuation, which peaked at $100 billion in 2022, dropped by a third in a recent funding round. Meanwhile, Temu, which entered the market in 2022, overtook Shein in U.S. market share by mid-2023.

In an effort to improve its reputation, Shein has launched social media campaigns, including influencer-led factory tours. However, critics argue that these efforts do little to address the company’s deeper ethical and environmental concerns. Shein has also relocated its headquarters from Nanjing, China, to Singapore and is diversifying its supply base by investing $150 million to support 2,000 Brazilian producers over the next three years.

Recently, Shein has expanded its business model by acquiring a stake in the parent company of Forever 21, Spark Group. Additionally, it is transitioning to a marketplace model, allowing third-party sellers to list their products on its platform. This move is expected to help Shein gain more market share as it continues its international expansion.

Conclusion

Shein’s rapid rise in the fast-fashion industry has been driven by its on-demand manufacturing, low-cost business strategy, and online-first approach. However, its success is overshadowed by allegations of labor exploitation, environmental harm, and tax evasion.

As Shein moves toward going public, it faces growing scrutiny from policymakers, consumers, and competitors. Whether the company can maintain its dominance while addressing these issues remains to be seen.

Shein’s marketing strategy ensures a seamless online experience across 150+ markets, offering diverse products and an app in 20+ languages to connect with global shoppers.

Shein’s marketing strategy relies on influencer collaborations, targeted social media ads, and an AI-driven on-demand model to maximize customer engagement and sales.

Shein’s primary customers are young, fashion-conscious consumers, mainly Gen Z and Millennials, who seek trendy yet affordable clothing.