At Viral Omega, we’re always studying how brands navigate shifting markets and consumer behavior. Some products manage to not just survive in tough industries but thrive. Today, we’re breaking down one of the most fascinating examples in recent history: the rise of Coke Zero.

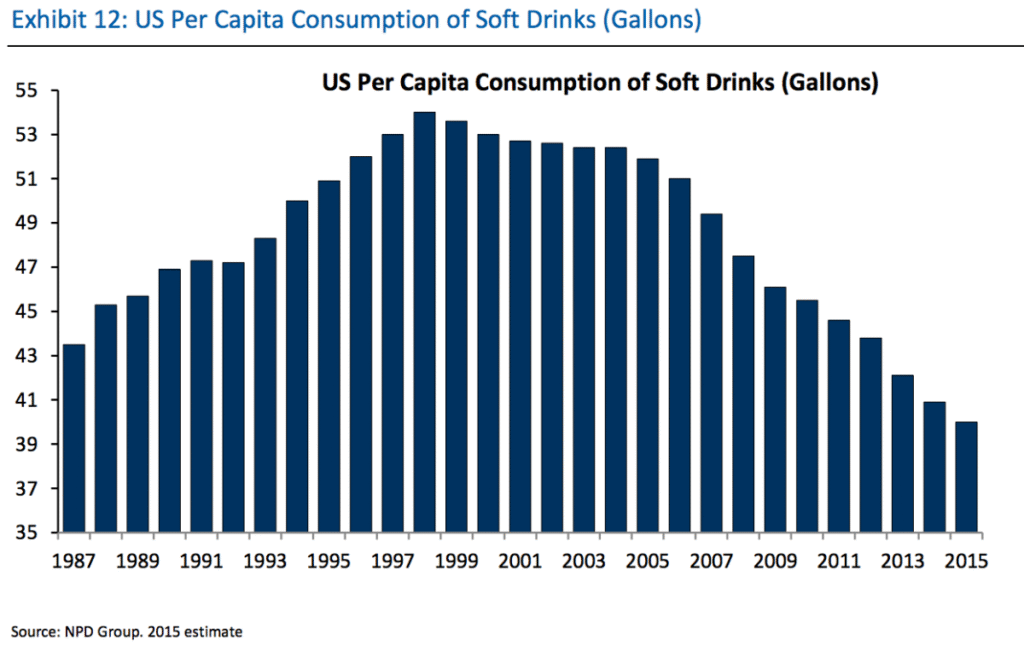

Take a look at this. A graph showing how many gallons of soda Americans drank annually. Unsurprisingly, we see this line steadily drop every year since 2004. What caught our attention was this: Coke Zero was launched around the same time this decline started. And yet, Coke Zero has experienced impressive growth since.

As of Q3 2024, it occupies double the growth rate of Coca-Cola’s entire product portfolio. The entire portfolio.

How is it possible that in a market abandoned by so many consumers, a product can grow this fast? As a digital marketing agency invested in how positioning and brand pivots succeed, we dug deep into financial disclosures, campaign archives, and consumer reactions to understand what made this happen.

The Brand Promise That Set It Apart

Let’s go to the months leading up to Coca-Cola Zero’s release in March 2005. The vice president of Coca-Cola’s diet portfolio said it best:

- Coca-Cola Zero is precisely what young adults told us they desired

- Real Coca-Cola taste

- Zero calories

- A new brand they can call their own

Even before Coke Zero hit shelves, Coke was planting the seeds of two of its core product pillars:

- Zero calories

- No compromise

Essentially telling consumers they could have their cake and eat it too. It would taste just like the original Coke Classic. A bold claim. The great refreshing taste you know and love, now in Coca-Cola Zero. Real Coke taste with zero calories.

Learning From Past Mistakes

Before Zero even launched, there was a decades-old problem Coke created for itself. Remember that whole zero compromise, just like classic Coke promise in every press release and ad? This wasn’t the first attempt.

Back in 1984, Coca-Cola held a market share of 22 percent. Even before that, in 1948, and it once owned 60 percent of the market. Four decades meant a 40 percent drop. That’s an issue.

From being the soda of American troops in both World Wars to becoming one of many in a crowded market. By 1985, Pepsi had climbed to a 19 percent market share. Coke’s market share was shrinking, sales velocity slowing, and Pepsi’s taste tests winning.

Faced with this, Coca-Cola tried something radical. It reformulated Coke Classic into New Coke. Removing the original product altogether for an improved-tasting formula.

The market reaction was swift. Consumers hated it.

Comments from a 1985 article captured the mood:

- I prefer the old Coke

- The new Coke tastes flat

- It tastes terrible and makes my teeth sharp

- I mourned my last bottle

- It tastes like dead old Coke

And people weren’t being dramatic for the sake of it. Coke was culturally synonymous with America at the time. After 79 days, the original Coke returned. New Coke flopped, hard.

Coke Zero’s Smarter Strategy

As a marketing agency, we recognise a risky product positioning when we see one. With a legacy like New Coke’s, most would steer clear of ever attempting something similar.

For the record, New Coke attempted to replace Coke Classic. Coke Zero did not. It was an additional product. Yet, its positioning was bold. It promised a very similar experience.

Their very first TV commercial literally converted a Coke Classic bottle into a Coke Zero bottle. A huge statement.

But this time, Coke threaded the needle.

Winning The Market With Smart Positioning

We asked ourselves, has a sequel product ever outperformed the original? Turns out The Hustle put together a great list of seven products that managed to do that.

From day one, Coke made sure Zero was everywhere:

- Super Bowl 43

- NASCAR

- A James Bond Skyfall campaign

It worked. In nearly every earnings release from 2005 to 2017, Coke highlighted Coke Zero’s continued success. Sometimes reasonable, sometimes aggressively bold growth metrics.

For example:

- In 2009, soda sales shrank by 2 percent

- Coke Zero sales grew 20 percent

- From 97 million cases to 116 million

Coke Zero almost never missed. It was the Michael Jordan of soft drinks, carrying the franchise and posting impressive growth after impressive growth.

Changing The Formula Without Losing The Consumer

In 2017, Coke’s senior VP of marketing, Stuart Kronauge, proposed something bold: Change Coke Zero’s taste. A risky move considering history.

Coke updated the recipe. Ingredients remained the same but the formulation of those ingredients changed. An improved taste, according to the company. Along with that, a name change from Coca-Cola Zero to Coca-Cola Zero Sugar and a fresh red-background design.

Even with all this, consumer loyalty stayed intact. The promise remained no compromise.

By 2021, Coke did it again. Another rebrand. Another recipe tweak. Two major adjustments in four years. A bold strategy, signaling either great pioneering or potential risk at the helm. Consumer tweets echoed New Coke memories.

Coke Zero Results

Nothing speaks louder than numbers, and the sales data confirmed it.

After the 2021 reformulation and rebrand, Coke Zero Sugar contributed 25 percent of Coke’s total growth in Q3 2021. Since then, year-on-year, double-digit growth.

How did this happen? Two reasons.

- Coke Zero wasn’t trying to beat Pepsi, Dr Pepper, or anyone else. It made a promise to its consumer. Zero compromise on taste.

- It learned from New Coke’s failure. Don’t take anything away. Let consumers have both.

Coke Zero proved you should never force consumers to pick either or. Instead, invite them to say both please.

Pepsi Zero currently owns 1.2 percent of the carbonated soft drink market. Coke Zero holds 4 percent. Four times the market share. When your product commands four times the market share of your closest competitor, you own the hill. No contest.

Final Thoughts From Viral Omega

In 1995, Coke CEO Roberto Goizueta called the New Coke risk one of the best they ever took. Difficult to disagree, considering what came after.

This is a masterclass in brand management, market risk-taking, and understanding consumer psychology. When executed right, bold pivots paired with learning from past missteps don’t just salvage a brand; they redefine category leadership.

That is why you should always emphasize the power of positioning, market listening, and strategic innovation.

Coke Zero occupies double the growth rate of Coca-Cola’s entire product portfolio in Q3 2024, making it the fastest-growing soda in a declining carbonated beverage market.

In March 2005, Coca-Cola stated Coke Zero was exactly what young adults told them they wanted, offering real Coca-Cola taste, zero calories, and a brand of their own.

Since launch, Coke Zero almost never missed, achieving twenty percent growth in 2009 while soda sales shrank by two percent, consistently delivering banger quarter after banger quarter.